In an earlier article, we covered how to make projections. Last month, we began to discuss stress testing. This month, we’ll delve further into stress testing.

Revenue

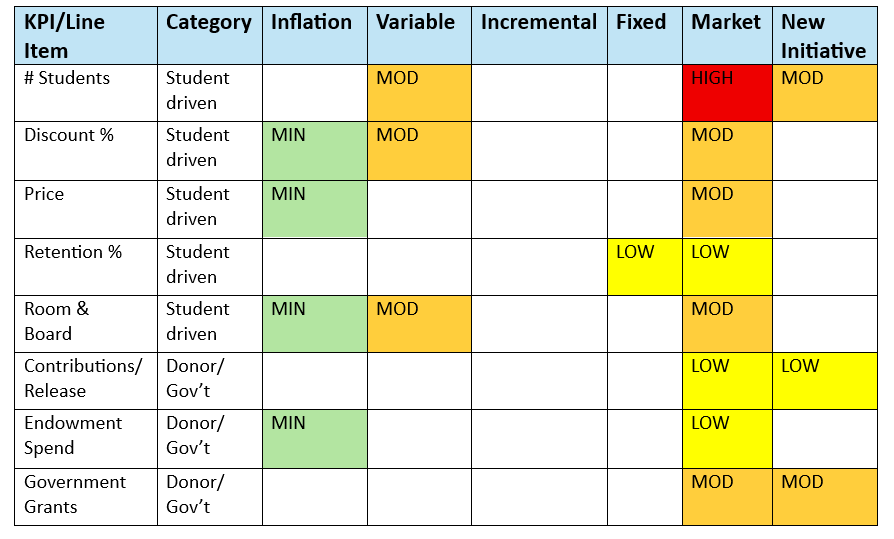

The most challenging assumptions in the current market relate to revenue, more specifically student-related revenue. This is made more challenging by the traditional approach of growing revenue to support the growth in expenses. In the current market, it is difficult to grow revenue, placing more pressure on controlling or reducing expenses.

Net tuition revenue = Recruiting x Price x Discount x Retention

It is important to understand each of these important factors in relation to the net tuition revenue and each other. For example, with the current pricing pressures, it’s hard to imagine that the discount rate will increase while enrollments increase. Will discounts be driven higher by the pressure to enroll more students?

Enrollment / Recruiting

The combination of the demographic decline and the shift in high school students choosing not to attend college makes enrollment and recruiting a moderate risk.

Using historic and external market data, as well as high school graduation rates and institutional market share by state, we can predict the likely change in new enrollments over the next five years.

For example, when using the weighted average decline by market share, we can predict that many institutions in the northeast are likely to experience a 4-5% decline in enrollment over the next 5 years. Using historical data, what will the likely enrollments be each over the next 5 years?

Next, overlay management insights. What actions are the institutions taking to manage this decline? Are there new programs or sports that will add to the enrollment? Are there new processes for recruiting or changes in strategy? Are there any early indicators available for next year (i.e. early applications) that support the assumptions?

Price

It is difficult to think that prices will increase by more than 3% soon, and there will still be significant pressure on pricing. We need to consider a few factors:

- What is the sticker price of your cross listed competitors (Where else do students apply when they apply to your institution?) If your price is already higher than these peers, are you losing applicants because of that price?

- Are you approaching a new threshold of price (i.e. $50,000, $90,000, $100,000 cost of attendance). I think about the way stores price items at $49.99 because it seems like they’re less than $50. Is this something we should consider at the institutional level?

- What is the impact on net tuition if we do not increase prices? This is generally the mechanism for reducing the discount rate on returning students. If we do not increase our prices, how will we afford inflation and cost of living increases?

Discount / Financial aid – moderate risk with market pressures

I am not a financial aid strategy expert, and this subject is complex. However, we are in a race to the bottom at this moment. It is driven by pure economics. When demand declines and supply is still high, prices are driven down. That is exactly what has been occurring in higher education which has seen a net price decrease two years in a row.

The pressure to fill those empty seats and beds caused institutions to increase discounts to meet enrollment goals. That pressure increased with the decline in international enrollments, PLUS loan limits and current market conditions. Even the most selective institutions will be responding to these pressures. This will have a trickle-down effect on higher education. The lower an institution is on the selectivity scale, the greater the pressure to discount to meet enrollment goals.

- What is the net price by income bracket for the institution compared to cross listed peers? Is there opportunity to attract a higher number of upper-income bracket students with a slightly higher discount?

- If you leverage a third party for discounting strategy, what do their scenarios tell you about your need to discount to meet your enrollment targets?

- Are there changes in processes for communicating about aid that will help families fund their education?

Retention – of the 4 components of NTR, this is the one you can control the most

- What does the recent trend in retention by year tell you about the future? Retention should be examined not just for fall to spring or freshman to sophomore year, but also for each successive year.

- Are projected increases in retention reasonable? It is difficult to increase retention by more than 2% in one year.

- Are there new strategies to increase retention? What are they and how will they help?

- Is there a change in the profile of students being recruited that will either help or hurt retention (i.e. GPA can be a strong correlator for retention)?

Room & Board Revenue

- What percentage of students have lived on campus historically? Will that change over time?

- If there is a shift in the percentage of students living on campus, is that because of a shift in policy (i.e. on campus requirements) or price?

- Are there housing capacity caps that will be hit soon?

In this market I am not recommending building additional housing units, but I am considering ways to make existing units denser. For example, can you convert singles into doubles? Are there neighboring houses that can be leased to fill capacity for the short term?

Grants & Contracts

What is the period of availability for most current grants and contracts? Are those likely to be renewed? What is the plan for replacing grant funding when the current grants expire? What impact will this have?

Fundraising/Contributions

- Is the future projection consistent with the past?

- Were there or will there be any campaigns moving forward?

- Are there any large, unusual gifts in prior or future years? How does that impact the normalized projections?

- If contributions are projected to increase, what is the strategy for those increases?

- If there are capital campaigns, will they take away from the normal annual fund giving?

Spend on endowment

Because spending on endowment is a function of investment markets, it can be difficult to predict market downturns. Most institutions set a return objective somewhere between 7-7.5% and plan to spend between 4-5% and invest the difference.

The 5% is based on a 3-year average market return, so the impact of any downturn would be lessened by the length of time it takes for the market to recover. Also, UPMIFA (Uniform Prudent Management of Institutional Funds Act) was designed to provide stability and preserve purchasing power over time. Many institutions have accumulated significant unspent earnings. Will those unspent earnings be enough to offset a higher spending rate? Will the board or management approve a higher spending rate if the market conditions require it?

Are there additional donations expected for the endowment? If the institution is borrowing from the endowment or using board-endowed funds to support deficit spending, how does that impact market value and returns over time?

Release from restriction

This is related to both fundraising and spending on endowment. Is this amount consistent with trends in each of those areas? Are there any large, unusual releases in prior or future years? How do those impact the normalized view of releases?

Expense

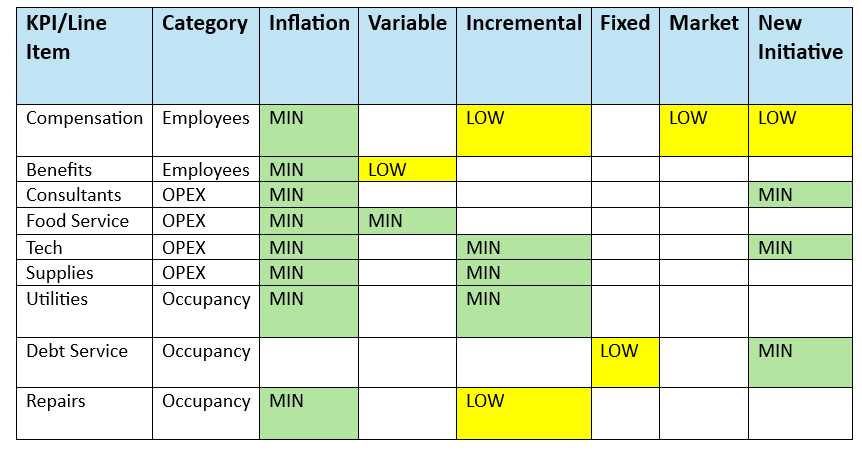

Expenses are easier, unless there are reductions or incremental thresholds are reached.

In general, when examining an institution’s annual cost of living adjustments, are future adjustments consistent? If they are lower, what impact will this have on turnover and the pressure to replace positions at a higher cost?

For non-compensation expenses, are annual inflation increases consistent with CPI predictions?

Are additional positions or operating expenses necessary to respond to planned initiatives to meet revenue targets?

If position or operating expense reductions are assumed, in what areas will those occur? What impact are these likely to have on meeting revenue goals?

Of course, none of this really considers new initiatives, like new sports, new academic programs, etc. The financial model for those should be evaluated individually to ensure the underlying assumptions are reasonable.

Liquidity

I have shared my calculation for this in an earlier article. Most of the inputs are stress tested as part of revenue and expenses including investment returns and spending. At the end of your projection period, do you have unrestricted liquidity remaining? Is it adequate to provide a cushion in the event of unexpected outcomes in any year?

Of course, if it is negative by more than 25% of your restricted fund value (unrestricted liquidity deficit/restricted net assets), you should determine if you can get access to liquidity through the sale of an asset or donor gift. Otherwise, it may be time to assess the ability to keep your doors open.

Conclusion

It is important to remind management that the goal is to gain clarity on their assumptions and their plan for achieving success, reducing the likelihood of a negative surprise.

Photo by Christina @ wocintechchat.com on Unsplash