First, it is important to clarify that financial stability includes both curricular and non-curricular activities. It is about the institution as a whole asking how much do we spend per student on each activity? Are we getting the outcomes we want? Is there a way to do it differently and achieve financial stability?

I have a few ideas about that.

Cost-cutting and efficiency are new to us

We have never been asked to do this as an industry. When we increase prices and students keep coming, we make no effort to become more efficient. In the for-profit sector, they are motivated by margin, so they continuously ask efficiency questions. We simply do not know how to do this. Even our finance folks are struggling with how to look for efficiencies, especially because, for decades, we have operated within our “cylinders of excellence”.

Not me!

When you tell leadership we are losing money and need to go through this exercise, everyone naturally says, “Not me, but them”. After the 2007/08 recession we cut administrative expenses, food, and travel in response. This was not creative. It was easy, but that was not a long-term market downturn. The magnitude of the problem we face now will not allow us to take that approach again. There are not enough dollars in those line items. We will need to reduce the number of people across the institution, but how? This is hard because you can’t eliminate people and ask other employees to absorb their workloads. You must perform a stoplight exercise. What do we keep doing, do differently, or stop doing entirely?

Hang on to every student!

We think we need every student, so we continue to graduate 2 (or even 10) students per year from a program. When we do that, we lose a significant amount of money. Running upper-level courses for those few students simply doesn’t pay. Even when we look at history, we see most of those programs have become less popular and are graduating with fewer students each year. Most small private schools lose money on courses with fewer than 15 students in them. If you have enough courses running with larger numbers, it can even out, but if not, you have a problem. Instead, we tend to create more majors to keep our faculty busy and hope we attract a few more students. Mathematically speaking, you need 100 students for each program to be financially sustainable. While I know this is hard to hear, we need to eliminate low enrolled majors and likely the faculty who teach in them. Yes you may lose a handful of students, but you will save more money that you lose in students. Perhaps this will free up money to invest in new majors?

Financial stability vs a declining student population

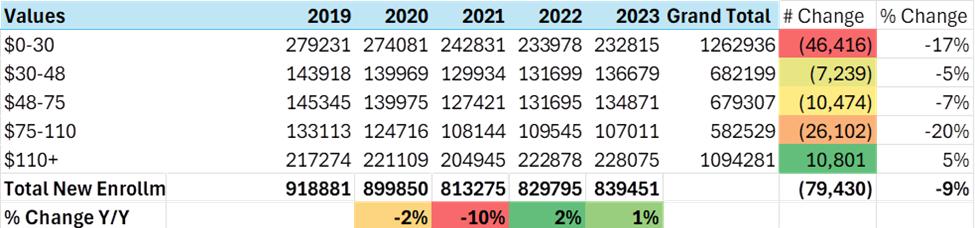

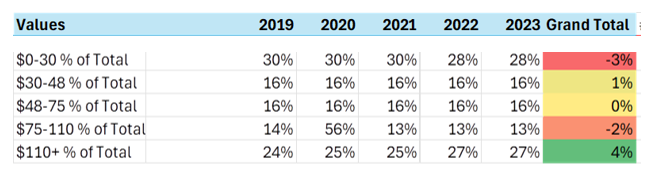

Our issue is that we have added new majors, while the number of students over the past 5 years has declined by 9% (10% for privates, and 8% for publics), as shown below form IPEDS data. As a result, our classes are smaller and continue to decrease in size.

We are discounting tuition at higher rates, so most students are paying less, especially in the lowest income bands which make up 40% of our students. The highest income bands have been paying more and have become price sensitive. This is causing a decline because students in every income bracket, other than above $110,0000 are saying no, they can’t afford to go to college.

When we look at the data, we see degrees like English, history, and languages are graduating fewer students. This does not mean you eliminate those departments — you need them for the core curriculum. It means you decide whether you can afford to offer the degree or a different, more appealing degree, perhaps by combining or starting new programs. When customers stop buying a product, but we keep making it, we miss the boat.

Communicate issues to all departments

This brings me to my final answer: Financial stability takes education and awareness. We need to show the numbers to the people across campus so they can be part of the discussion. Without information and context, it’s hard to know where to start. That’s why it’s easy to point to other areas for cuts, rather than devise a solution.

Photo by Ruijia Wang on Unsplash